INTRODUCTION

As global efforts to mitigate climate change intensify, carbon markets have emerged as a crucial mechanism for reducing greenhouse gas emissions. These markets provide economic incentives for companies and countries to lower their carbon footprints by trading carbon credits. This document aims to provide a comprehensive overview of carbon markets, including their mechanisms, the benefits they offer, how carbon trading works, the types of market mechanisms in place, and the economic incentives for participating entities and technology.

BACKGROUND & MARKET TYPE

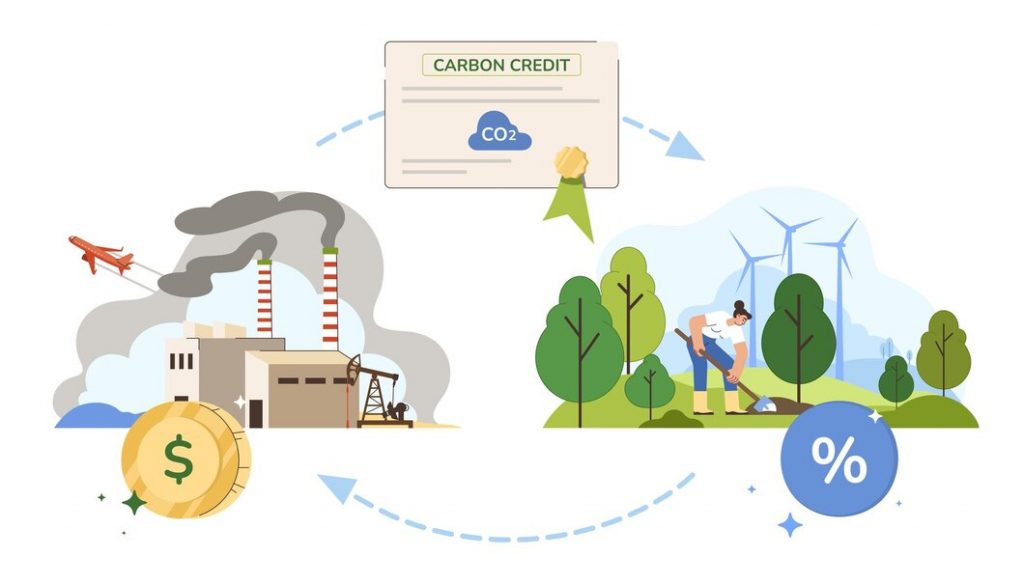

Carbon markets are a component of international and national strategies to address climate change by placing a monetary value on carbon emissions. The basic principle behind carbon markets is to create a financial incentive for reducing greenhouse gas emissions, typically measured in metric tons of carbon dioxide equivalent CO₂e. The markets operate through a system of carbon credits, where each credit represents the right to emit one metric ton of CO₂e.

There are two main types of carbon markets:

Compliance Markets: These are government-regulated markets where entities are legally required to adhere to emission reduction targets. Examples include the European Union Emissions Trading System (EU ETS) and California’s Cap-and-Trade Program.

Voluntary Markets: In these markets, companies, governments, or individuals purchase carbon credits on a voluntary basis to offset their emissions. This is common among organizations looking to enhance their sustainability profiles.

MECHANISMS OF CARBON MARKETS

Carbon markets function through various mechanisms designed to reduce GHG emissions and facilitate the trading of carbon credits. The most common mechanisms include:

- Cap-and-Trade Systems: The most common mechanism is the cap-and-trade system, government or regulatory body sets a cap on the total amount of greenhouse gases that can be emitted by covered entities. Companies are allocated or can purchase emission allowances, which they can trade with other companies if they emit less than their allotted amount. The cap is gradually reduced over time to encourage overall emission reductions. The European Union Emissions Trading System (EU ETS) is a prominent example, covering over 11,000 power stations and industrial plants across the EU.

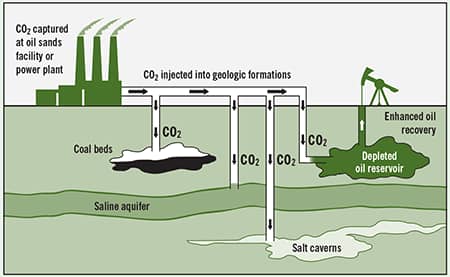

- Carbon Offset Mechanisms: These mechanisms involve the creation of carbon credits through investments in projects that reduce or sequester CO₂. These would typically include reforestation, renewable energy projects, and methane capture from landfills. These credits can be sold to entities looking to offset their emissions. The Clean Development Mechanism (CDM) under the Kyoto Protocol is a well-known example.

- Baseline-and-Credit Systems: In this system, companies earn credit by reducing their emissions below a baseline level set by regulators. These credits can then be sold in the market.

- Carbon Taxes: While not a trading system, carbon taxes are a market-based mechanism where entities pay a tax for their carbon emissions. This approach provides a direct economic signal to reduce emissions by making it more costly to emit CO₂.

There are multiple systems are implemented in regions all over the world, some entities operate a hybrid solution by combining elements of cap-and-trade, offset and credit and even carbon taxes to provide flexibility and certainty in carbon reduction.

BENEFITS OF CARBON MARKETS

The implementation of carbon markets offers several significant benefits:

- Cost-Effective Emission Reductions: Carbon markets allow companies to achieve emission reductions at the lowest possible cost. By trading carbon credits, companies that can reduce emissions cheaply can sell excess credits to those for whom reductions are more expensive.

- Innovation: The financial incentives provided by carbon markets encourage companies to invest in new technologies and practices that reduce emissions. This can lead to the development of cleaner technologies and more sustainable business practices.

- Supporting Sustainable Development: Carbon offset projects, particularly in developing countries, can provide additional benefits beyond emission reductions, such as job creation, improved air quality, and biodiversity conservation.

- Enhanced Corporate Responsibility: Companies participating in voluntary carbon markets can improve their reputation and meet consumer demand for environmentally responsible practices.

- Global Emission Reductions: By allowing the trading of carbon credits across borders, carbon markets can facilitate global cooperation on climate change, enabling countries to meet their emission reduction targets more effectively.

HOW CARBON TRADING WORKS

Carbon trading involves the buying and selling of carbon credits, which represent a reduction or removal of one metric ton of CO₂. The process typically works as follows:

- Emission Caps or Targets: Governments or regulatory bodies set emission caps or reduction targets for specific sectors or companies.

- Allocation or Auction of Allowances: Companies are allocated a certain number of carbon allowances, either for free or through an auction process.

- Emission Monitoring and Reporting: Companies must monitor and report their emissions to ensure compliance with their allocated allowances.

- Trading of Allowances: If a company emits less than its allocated allowances, it can sell the excess to another company that needs more allowances to cover its emissions.

- Compliance: At the end of a compliance period, companies must surrender enough allowances to cover their emissions. Failure to do so can result in fines or penalties.

ECONOMIC INCENTIVES FOR PARTICIPATING ENTITIES AND TECHNOLOGY ADOPTION

The economic incentives provided by carbon markets are a driving force behind participation and technological innovation:

- Revenue Generation: Companies that reduce emissions beyond their targets can generate revenue by selling excess allowances or credits.

- Cost Savings: By investing in emission reduction technologies, companies can lower their compliance costs and reduce future liabilities associated with carbon pricing.

- Risk Management: Participation in carbon markets allows companies to manage their exposure to future carbon regulations and potential price increases.

- Access to New Markets: Companies that adopt low-carbon technologies can gain a competitive advantage in markets where carbon pricing is in place or where consumers demand environmentally friendly products.

- Investment in Innovation: Carbon markets create demand for new technologies that reduce emissions, leading to increased investment in research and development.

CASE STUDY

Let’s have a look at what companies across the globe have been up to in terms of reducing their carbon emissions.

Microsoft’s Carbon Reduction Efforts:

Microsoft provides a compelling example of a comprehensive carbon reduction strategy. The tech giant has committed to becoming carbon negative by 2030 and aims to remove all carbon it has emitted historically by 2050. Microsoft has implemented a range of measures that leverage both compliance and voluntary carbon markets:

- Microsoft set concrete targets and started reporting annual emissions early, committing to carbon neutrality for Scope 1 and Scope 2 emissions as far back as 2012.

- In 2012, Microsoft introduced an internal carbon fee, charging each department for emissions associated with their operations. This fee incentivizes departments to adopt greener practices, as the funds collected are reinvested in sustainability projects, including purchasing carbon offsets and investing in renewable energy.

- The company also invested in emerging carbon removal technologies. These include direct air capture, reforestation, and soil carbon sequestration projects. In 2020 alone, Microsoft purchased 1.3 million metric tons of carbon removal, a mix of nature-based solutions and emerging technologies.

The company buys carbon credits from reputable sources, including projects focused on reforestation, land restoration, and renewable energy. By engaging with carbon markets, Microsoft not only offsets emissions but also supports projects that contribute to sustainable development goals.

Additional examples of organization’s carbon reduction efforts include:

- Hewlett-Packard (HP): HP, one of the first major companies to report its greenhouse gas emissions transparently. It implemented sustainability initiatives like recycling programs to reduce landfill waste and harmful chemicals in manufacturing. HP has become a strong advocate for corporate sustainability.

- Apple: The company has committed to running all its production facilities on renewable energy, contributing to its goal of achieving net-zero emissions.

- Google: Google is working toward a carbon-free goal by 2030. The company focuses on supply chain emissions, with initiatives for refurbishing and recycling data center components through its partnership with the Ellen MacArthur Foundation.

- Disney: Having implemented a zero-waste policy to ensure that none of its waste ends up in landfills, Google is aiming for closed-loop, sustainable operations.

CONCLUSION

Carbon markets are a powerful tool in the global effort to combat climate change. By providing economic incentives for emission reductions and facilitating the trading of carbon credits, these markets promote cost-effective solutions, drive technological innovation, and support sustainable development. As carbon markets continue to evolve, they will play a crucial role in achieving global climate goals and transitioning to a low-carbon economy.

We would love to hear from our readers. Please send your comments, feedbacks and questions to info@tetracoregroup.com

Authors: Yusuf Yisa, Firdaos Abubakre, Joy Eshomeme and Nkiruka Onwordi.